As of 2023, there have been a few changes to the U.S. federal solar tax credit. The tax credit policy got an update and a boost under the Inflation Reduction Act (IRA). The act introduced two new ways to monetize tax credits: direct payments and transferable mechanisms. These new mechanisms are meant to make it easier for people to get tax credits and grow the market for financing green projects with tax credits. This should make it more efficient to use tax credits for clean energy and get more investors interested in the new energy industry.

The Direct Payment Mechanism lets eligible tax-exempt entities, even if they're tax-exempt, apply for and get a cash payment equal to the amount of tax credits they're entitled to. Transferable mechanisms, on the other hand, let new energy project developers transfer tax credits more directly to third parties. This reduces the need for complex tax equity structures for financing new energy projects, which expands the potential financing market.

What’s the Solar Tax Credit?

The federal solar tax credit, also called the investment tax credit (ITC), is a federal tax incentive meant to encourage investment in certain types of assets, often related to renewable energy, energy efficiency improvements, or other areas the government is interested in. In the solar sector, the ITC lets individuals or businesses deduct a percentage of their investment costs from their federal taxes when they install a solar system. This means that investors can get a certain amount of tax relief based on what they spend on their solar project.

Here are some of the main things to know about the ITC:

- The percentage of the ITC credit changes over time. For instance, before the Inflation Reduction Act, the solar ITC credit percentage was gradually cut from 30% to 22%. However, the IRA brought it back to 30 percent and extended it through 2032.

- The ITC applies to the installation of commercial and residential solar energy systems, including photovoltaic panels, solar water heaters, and solar thermal systems.

- The IRA also gives businesses that don't usually have to pay tax (like non-profits) the option of getting a direct payment equal to their ITC amount.

- In some cases, ITCs can be transferred, which means that solar project developers can sell tax credits to other taxpayers to raise money for the project.

Solar Tax Credit Developments

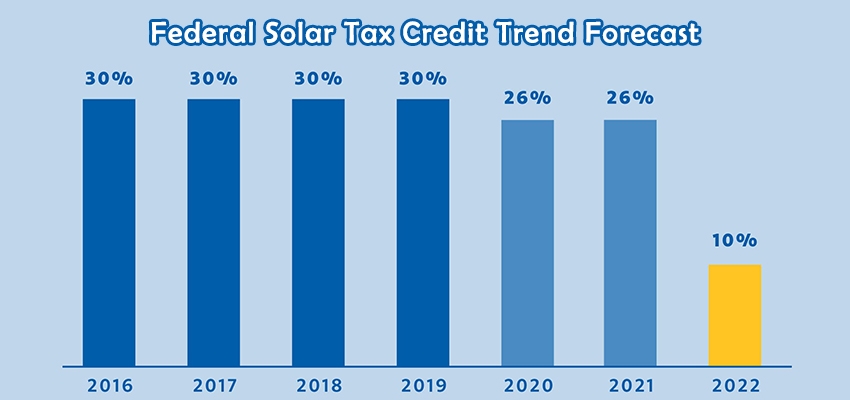

The original ITC was set to expire at the end of 2007. Luckily for many homeowners, a series of extensions pushed the expiration date back to 2016. Congress then decided to add another five years to that period, with the credits changing at the end of this year. Here is a breakdown for the sunsetting of the credit:

- From 2016 to 2019, the tax credit will stay at 30 percent of the cost of the system.

- By 2020, the tax credit will be reduced to 26% of system costs.

- By 2021, the tax credit will be 22% of the system cost.

- By 2022 and beyond, businesses will no longer receive tax credits for solar panels, while homeowners will not be eligible for any credits.

The solar investment tax credit is gradually reduced through 2019. Previously, the solar ITC started to be phased down in 2020, from 30% to 26%. It's scheduled to keep going down in subsequent years until it's completely eliminated. So, 2019 is the last year you can claim the full tax credit. But the IRA changed that, increasing the credit from 26% to 30% and extending it to 2032. If you buy solar panels now, you'll still get the maximum tax deduction.

What Impact Will This Have on the U.S. Solar Industry?

Attracting Investors

Raising the ITC from 26% to 30% makes solar projects a lot more attractive for investors. Higher tax credits mean a faster return on investment, which is a big draw for more investors and developers to the market. Extending the ITC policy to 2032 gives the market long-term stability, which helps the solar industry keep growing and planning. Industry participants can make investment and expansion decisions with more confidence because they know what the future holds.

Creating Jobs

With more investment, we're seeing more money being spent on research and development, which is driving advances in solar technology and reducing costs. This makes solar more attractive to consumers. The solar industry is growing, and that means more jobs. From installation to manufacturing to R&D, we need more people in all areas to meet market demand.

Expanding Markets

New direct payments and transferable mechanisms have made it possible for more people to use tax credits, including groups that would otherwise not have benefited directly because of their tax status. This has helped the market become more diverse and grow.

Transition to Clean Energy

As renewable energy sources like solar become cheaper and more common, traditional energy markets may have to compete more to make the switch to cleaner, more sustainable energy sources. This could help the U.S. meet its renewable energy and greenhouse gas emissions reduction goals, which would put us on the path to a more sustainable future.

The report shows that the U.S. PV industry added 32.4 GW of installed capacity in 2023, which is a 51% increase from 2022. This growth is mostly thanks to finished projects and a more stable supply chain. PV installations are expected to grow by 17% in 2024, which will create even more jobs. If supply chains are constrained, tax credit financing is reduced, and interest rates stay the same, growth in PV installations will only be 24%. This shows how tax credit policies can really help the industry grow and create jobs.

Time to Switch is Now

While installing a solar power system is pretty quick and easy, there are still a few steps to take before you can switch it on. You've got paperwork, permits, finances and everything in between to think about. So, now is the perfect time to go solar. Don't wait until the end of the year to choose solar – you don't want to miss out on savings. Get in touch with PowerHome today to get started.

(1).png)

(1).png)